Education

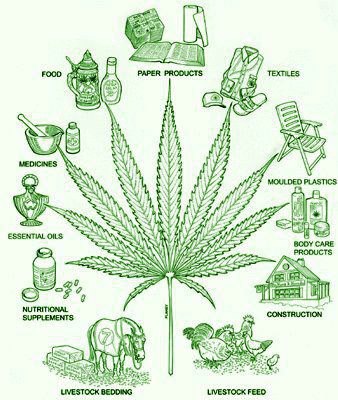

The global industrial hemp market size was estimated at USD 3.9 billion in 2017, expanding at a CAGR of 14.0% over the forecast period. Growing demand for hemp-based food products including cooking oil, dairy alternatives, flour, and salad dressings is expected to drive market growth. In addition, rising demand for bakery products such as bread and cookies is expected to drive the market. Commercial cultivation of the product is restricted in several countries across the globe, on account of which, the industry is largely dependent on import of raw fibers, seeds, and finished products. As of 2017, around 36 countries grew industrial hemp, in accordance with provisions specified by the department of agriculture in respective countries.

Regulators, such as the Controlled Substances Act of 1970, Agricultural Act of 2014, or the 2014 Farm Bill, U.S. Drug Enforcement Agency (DEA), and Industrial Hemp Act 2017 set legislative procedures and allowed THC content in cultivation, processing, marketing, distribution, and consumption. This has majorly influenced industry growth.

Processing facilities extract required components from raw hemp with the help of processing and manufacturing equipment. However, low yield availability, lack of harvesting innovations and processing facilities, and difficulties in transporting the product in highly regulated markets are factors hampering market growth.

The political link between industrial hemp and marijuana has resulted in several restrictions on hemp cultivation, processing, distribution, and consumption across the globe. However, increasing liberalization and legalization for hemp cultivation with THC content not more than 0.3 in several countries is expected to have a positive impact on market growth.

The hemp seeds segment is likely to expand at a CAGR of 17.1% during the forecast period, in terms of revenue. This growth is attributed to rising demand for oil, seedcakes, and various food and nutraceutical items. Nutraceutical products are known for their high fatty acid content and nutritional value. Seeds comprise about 35.0% oil, which contains roughly 80.0% essential fatty acids and 20.0% crude protein.

Fiber accounted for 40.4% of the revenue in 2017 on account of high demand from the textile industry for manufacturing of yarns, spun fibers, and range of consumer and industrial textiles. Hemp fibers are robust, contain high amount of hemicellulose, and have a high absorbent capacity, which makes it useful for the textile industry. Shivs are the inner core part of stalks harvested from industrial hemp crop and cost half the value of fiber owing to which, it is majorly used in several application industries. Shivs are majorly used in animal bedding and manufacturing of construction and insulating materials, rising consumer demand for green buildings owing to increasing environmental pollution is expected to drive the shivs segment over the forecast period. Growing awareness regarding dietary advantages of seed and seed oil derived from the crop and extensive use in cosmetics and personal care industries indicate that the product has higher potential as an oilseed crop than as a fiber. Furthermore, increasing demand for hemp-based technical products including oil paints, varnishes, biofuel, solvents, and coatings is expected to drive market growth.

The Customers

The textile industry is one of the largest consumers in the industrial hemp market as it is used in manufacturing apparel, fabrics, denim, fine textiles, and others. It is also used in manufacturing several industrial textile products such as twine, rope, nets, canvas bags, tarps, carpets, and geotextiles. This application segment is expected to grow on account of high strength offered by fibers.

The personal care industry is expected to register a revenue-based CAGR of 15.9% from 2018 to 2025 on account of high fatty acid content of the product. Body care products containing seed oil reduce skin discomfort by soothing and restoring dry or damaged skin and also help slow down aging process, which is likely to drive demand.

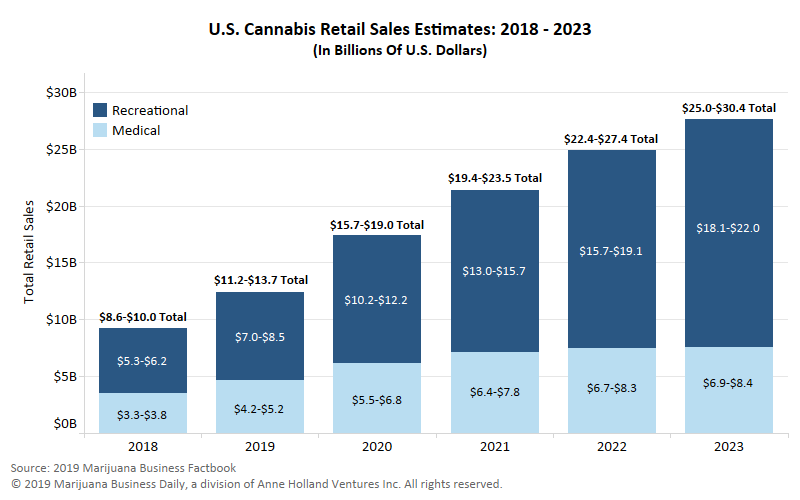

Market Analysis

Industrial hemp is an agricultural product and widely used in the animal care industry. Seeds derived from the crop are high in protein content as well as nutritional value and are used in animal feeds and as bird seeds. Shivs and leaves are largely used in animal bedding, primarily for poultry and horses, owing to low dust and high absorbent property of shivs. This is likely to drive market growth over the next few years.

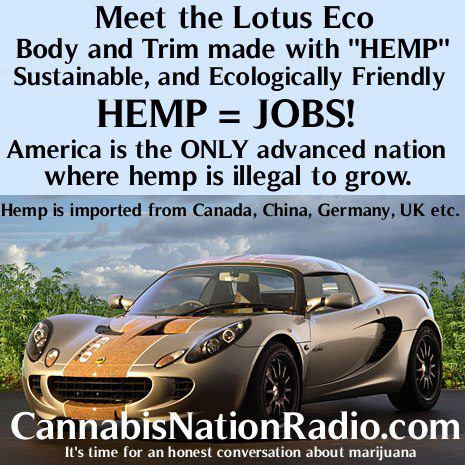

The automotive industry is projected to expand at a revenue-based CAGR of 13.6% over the forecast period on account of stringent regulations regarding usage of harmful synthetic materials. Different automotive, ground transportation, and aerospace products such as auto parts (i.e., headliners), interior bus panels, and composite parts are manufactured from fibers. This is anticipated to fuel market growth in the coming years.

Regional Insight

North America is expected to exhibit a CAGR of 16.9% in terms of revenue as it is a major consumer of seed- and fiber-based products, primarily used in food and beverages, textile, and personal care industries. Growing geriatric population and rising concerns about skin diseases and UV protection are expected to drive demand for hemp oil from the personal care industry in the region.

Europe is the third-largest market in terms of volume as well as revenue. Product demand in this region is driven by growing application of fibers derived from the product in the manufacturing of construction materials, fiberboards, and auto parts. Germany is one of the largest consumers of fiber composites due to its wide scope of application in automotive panels.

In terms of revenue, Asia Pacific is expected to register a CAGR of 15.9% from 2018 to 2025 due to increasing fiber consumption in manufacturing of biodegradable textiles for consumer and industrial applications. Presence of major supplier countries, including China, India, Australia, and South Korea, is expected to have a positive impact on the region’s growth.

The Central and South America market is driven by rise in consumption of oil derived from the product for pharmaceutical and food and beverage industry. High consumption of hemp-based foods and supplements owing to increased health issues such as cardiovascular diseases (CVDs) and other serious issues is expected to propel growth. This market report forecasts revenue growth at global, regional, and country levels and provides an analysis on latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global industrial hemp market report on the basis of product, application, and region:

Being that the Indigenous Hemp Education Association is a Unique one of a kind company there is no Competition to compare a sales strategy to. Now, 36 states have legalized hemp cultivation to varying degrees (some for research purposes only). The first commercial planting happened in 2013, when Colorado farmer Ryan Loflin harvested a 55-acre crop, the first in the nation since 1957.

The 2014 Farm Bill included a provision that allowed states to initiate research programs on hemp cultivation. Though the federal ban on commercial cultivation remained intact, this the new policy was taken as a sign that federal rules would eventually be loosened further, sparking a new wave of activity at the state level to legalize hemp and promote it as a viable crop. Since then, hemp has been planted in 19 states.